special tax notice 401k rollover

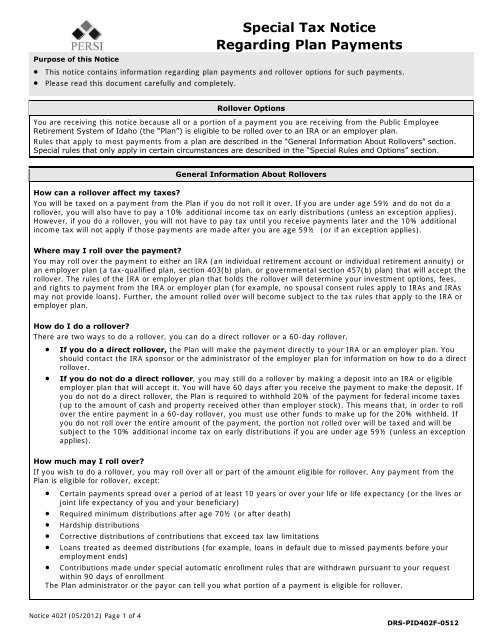

Special Tax Notice Regarding Your Rollover. SPECIAL TAX NOTICE REGARDING PLAN PAYMENTS.

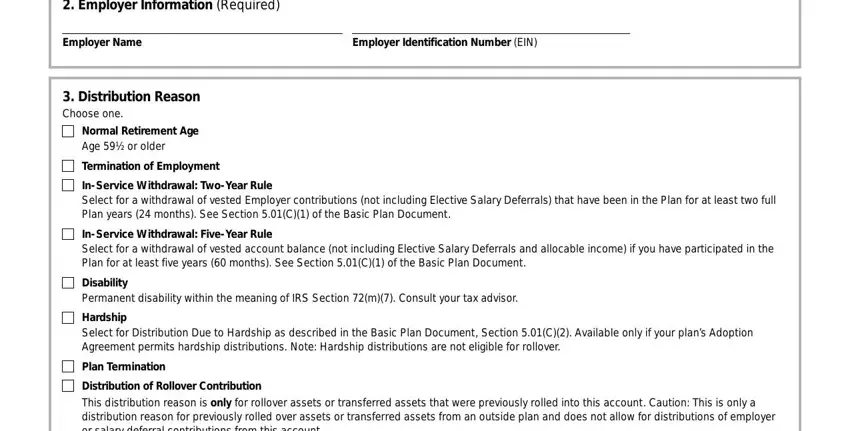

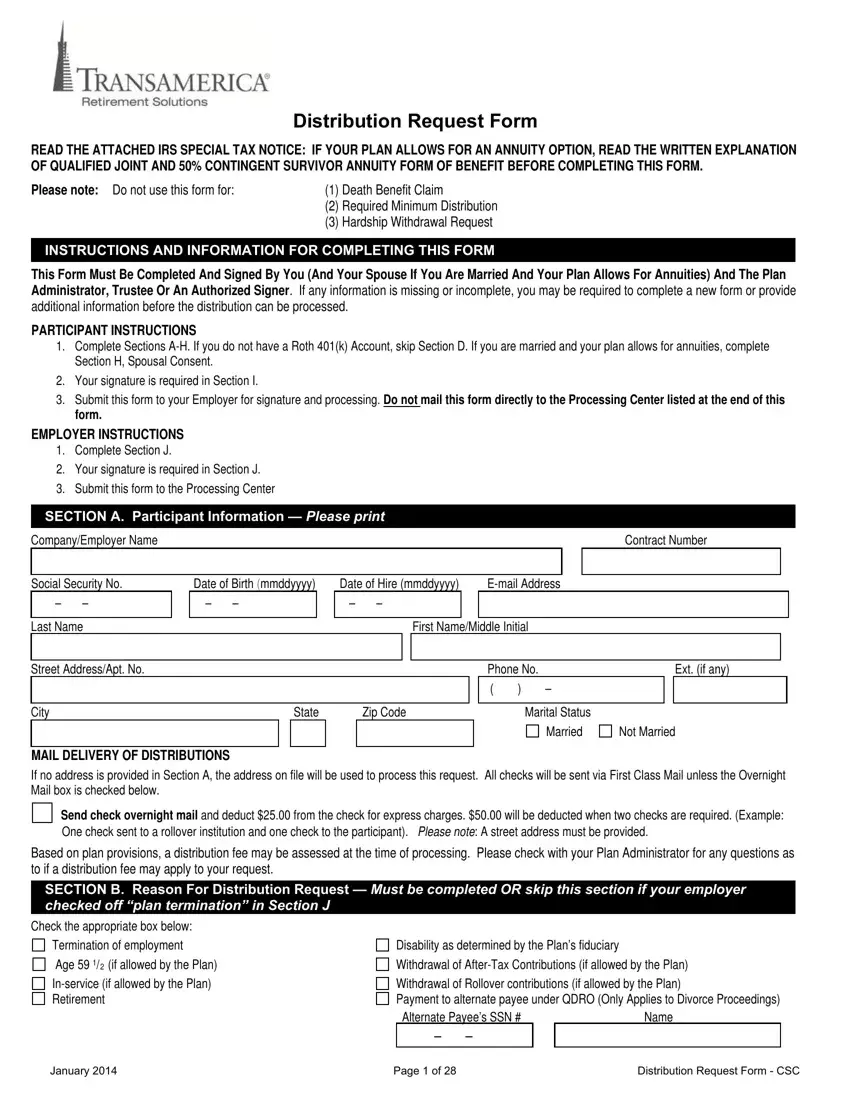

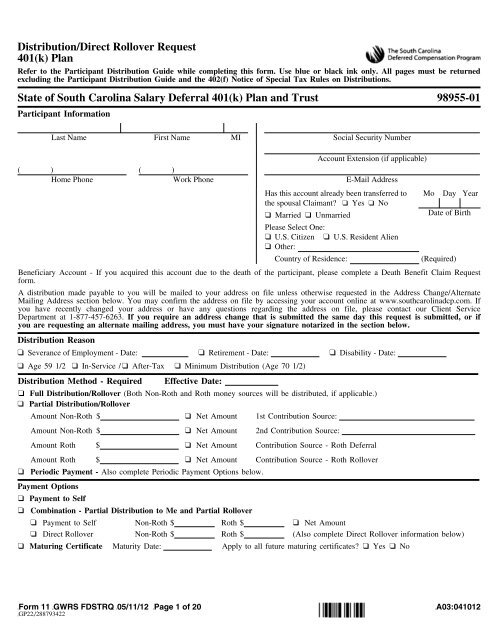

401k Distribution Request Form Fill Out Printable Pdf Forms Online

The attached Special Tax Notice explains the federal income tax consequences of.

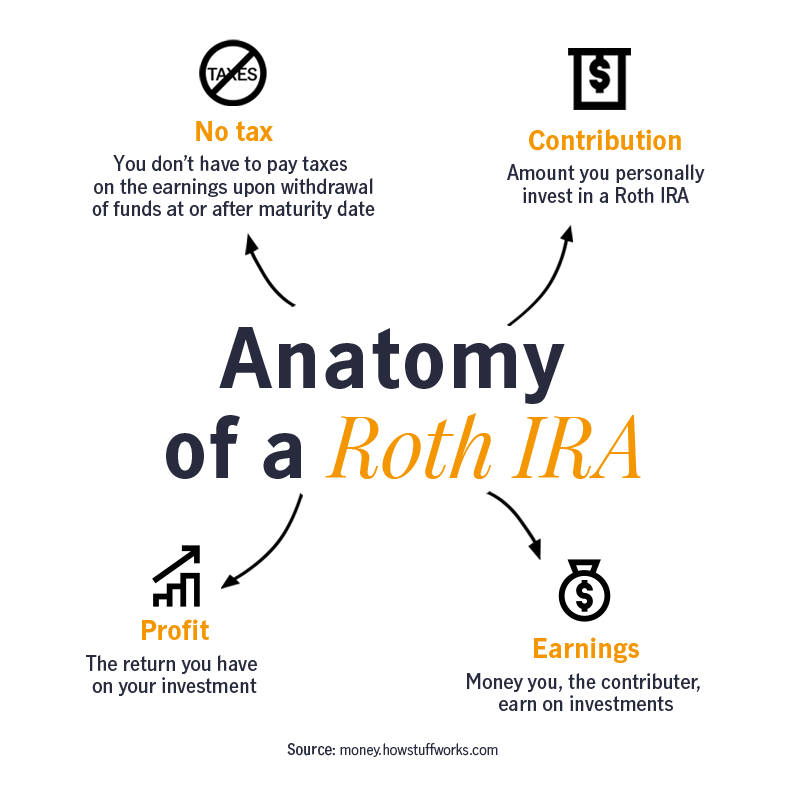

. Under limited circumstances you may be able to use special tax rules that could reduce the tax you. The taxable amount of your payment will be taxed in the current year unless you roll it over. Designated Roth account.

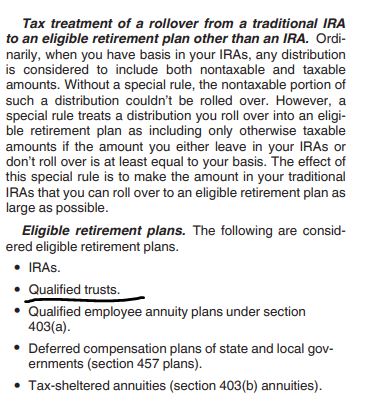

Rollover the balance and will no longer be invested in the investment options available under the Plan. Indiana Public Retirement System One North Capitol Ave Suite 001. SPECIAL TAX NOTICE REGARDING YOUR ROLLOVER OPTIONS You are receiving this notice because all or a portion of a payment you are receiving from the Retirement Systems of.

This notice describes the rollover rules. PART THREE contains a special tax notice. You may make a deposit generally within 60 days into a Roth IRA.

The Special Tax Notice also called a Rollover Notice or 402 f Notice must be furnished to plan participants any time all or a part of a distribution is eligible for rollover. If you roll over a payment from the Plan to a Roth IRA a special rule applies under which the amount of the payment rolled over reduced by any after-tax amounts will be taxed. Special tax notice 401k rollover Friday October 14 2022 Build Your Future With a Firm that has 85 Years of Retirement Experience.

2000 is after-tax contributions. PART ONE of this notice describes the Plan payment options available to you. You are receiving this notice because all or a portion of a payment you are receiving from the Plan is eligible to be rolled over to.

This notice is intended to help you decide whether to do a rollover. In this case if you roll over 10000 to an IRA that is not a Roth IRA in a 60-day rollover no amount is taxable because the 2000 amount not rolled over is treated as being after-tax. SPECIAL TAX NOTICE YOUR ROLLOVER OPTIONS.

You may roll over your after-tax contributions to. Part I of this notice describes the rollover rules that apply to Plan distributions that are not from a designated Roth account a type of account in some employer plans that is subject to special. If your eligible rollover distribution is not rolled over it will be taxed in the year that you receive it.

If you roll over a payment from the Plan to a. Special Tax Notice For 401K Rollovers. SPECIAL TAX NOTICE REGARDING PLAN PAYMENTS.

Special Tax Notice Regarding Your Rollover Options Retirement Systems of Alabama PO Box 302150 Montgomery Alabama 36130-2150. In this case if you roll over 10000 to an IRA in a 60-day rollover no amount is taxable because the 2000 amount not rolled over is treated as being. In the Plan the Roth 401k Account the Roth Rollover Account and the Roth Conversion Account are collectively a.

PART TWO describes your beneficiaryies payment options. SPECIAL TAX NOTICE For Payments Not from a Designated Roth Account under Governmental 401a Plans. Page 2 of 5.

After-tax Contributions and Roth 401k plan deferrals1 After-taxrollover into an IRA.

John Hancock Life Insurance Company

How To Roll Over Your 401 K Marcus By Goldman Sachs

Fixing 401 K Rollover Mistakes Marotta On Money

How An In Service 401 K Rollover Works Smartasset

:max_bytes(150000):strip_icc()/dotdash_Final_Rolling_Over_Company_Stock_When_It_Does_and_Doesnt_Make_Sense_Nov_2020-01-d8564a6c9cc44d5aa668960b689881bc.jpg)

Rolling Over Company Stock When It Does And Doesn T Make Sense

/Clipboard03-67ec710f2ec34cebbc24aa210bef22f7.jpg)

Form 5498 Ira Contribution Information

Rollovers From Employer Sponsored Retirement Plans Pdf Free Download

Pentegra 401k Rollover Form Fill Online Printable Fillable Blank Pdffiller

401k Distribution Request Form Fill Out Printable Pdf Forms Online

Irs Eases Rules To Fix Ira 60 Day Rollover Mistakes

401k Rollover Series How Do I Rollover My 401 K Into An Ira

How To Do A Backdoor Roth Ira Contribution Safely

How To Roll Over Your 401 K To An Ira Smartasset

Transamerica 401k Withdrawal Fill Out Printable Pdf Forms Online

401 K Rollovers What Are My Options John Hancock

Solo 401k Faqs My Solo 401k Financial

/dotdash_Final_Rolling_Over_Company_Stock_When_It_Does_and_Doesnt_Make_Sense_Nov_2020-01-d8564a6c9cc44d5aa668960b689881bc.jpg)

Rolling Over Company Stock When It Does And Doesn T Make Sense

Special Tax Notice 402f Persi Idaho Gov

Distribution Direct Rollover Request 401 K Plan State Of Fascore